8.7.2.9 Entry of arrears - LUPMISManual

Main menu:

×

- 0. Introduction

- 1. GIS handling

-

2. GIS data entry

- 2.1 Create new layer

- 2.2 Digitize line

- 2.3 Digitize point

- 2.4 Digitize polygon

- 2.5 Edit existing layer

- 2.6 Delete feature

- 2.7 Split line

- 2.8 Split polygon

- 2.9 Merge lines from different layers

- 2.10 Unite lines

- 2.11 Snap lines

- 2.12 Join polygons

- 2.13 Extend polygon

- 2.14 Insert island

- 2.15 Define unit surrounding islands

- 2.16 Create 'doughnut'

- 2.17 Fill 'doughnut' polygon

- 2.18 Fill polygon with 'holes'

- 2.19 Digitize parcels from sector layout

-

3. GIS operations

- 3.1 Create buffer

- 3.2 Create exclusion zone

- 3.3 Overlay units

- 3.4 Convert line to polygon

- 3.5 Derive statistics (area size, length)

- 3.6 Clip unit according to other unit

- 3.7 Create geographic grid

- 3.8 Move entire vector map

- 3.9 Move or copy individual features on a map

- 3.10 Adjust polygon to line

- 3.11 Convert points to polygon

- 3.12 Define by distance

- 3.13 Create multiple objects

- 3.14 Transfer styles from one layer to another

-

4. Attribute database

- 4.1 Start with database

- 4.2 Import database

- 4.3 Display database information

- 4.4 Enter attribute data

- 4.5 Attribute matrix of multiple layers

- 4.6 Seeds

- 4.7 Repair attribute data

- 4.8 Merge lines with attached database

- 4.9 Transfer attribute data from points to polygons

- 4.10 Copy styles, labels, attributes

-

5. Conversion of data

-

5.1 Points

- 5.1.1 Import list of points from text file

- 5.1.2 Import list of points from Excel file

- 5.1.3 Convert point coordinates between projections

- 5.1.4 Convert point coordinates from Ghana War Office (feet)

- 5.1.5 Convert point coordinates from Ghana Clark 1880 (feet)

- 5.1.6 Track with GPS

- 5.1.7 Download GPS track from Garmin

- 5.1.8 Download GPS track from PDA

- 5.1.9 Frequency analysis of points

- 5.2 Vector maps

- 5.3 Raster maps

-

5.4 Communication with other GIS programs

- 5.4.1 Import GIS data from SHP format

- 5.4.2 Import GIS data from E00 format

- 5.4.3 Import GIS data from AutoCAD

- 5.4.4 Export LUPMIS data to other programs

- 5.4.5 Export GIS to AutoCAD

- 5.4.6 Change a shape file to GPX

- 5.4.7 Transfer GIS data to other LUPMIS installations

- 5.4.8 Digitize lines in Google Earth

- 5.5 Terrain data

- 5.6 Export to tables

- 5.7 Density map

-

5.1 Points

-

6. Presentation

- 6.1 Labels

- 6.2 Styles and Symbols

- 6.3 Marginalia

- 6.4 Legend

- 6.5 Map template

- 6.6 Final print

- 6.7 Print to file

- 6.8 3D visualization

- 6.9 External display of features

- 6.10 Google

-

7. GIS for land use planning

- 7.1 Introduction to land use planning

- 7.2 Land use mapping for Structure Plan

- 7.3 Detail mapping for Local Plan

- 7.4 Framework

- 7.5 Structure Plan

- 7.6 Local Plan

- 7.7 Follow-up plans from Local Plan

- 7.8 Land evaluation

-

8. LUPMIS Tools

- 8.1 General

- 8.2 Drawing Tools

-

8.3 Processing Tools

- 8.3.1 UPN

- 8.3.2 Streetname + housenumbers

- 8.3.3 Address Database + tools

- 8.3.4 Format conversion

- 8.3.5 Coordinate system conversion

- 8.3.6 Raster processing

- 8.3.7 Altitude/DTM

- 8.3.8 Other GIS Tools

- 8.3.9 Utilities

- 8.4 Printing Tools

-

8.5 Permit Tools

- 8.5.1 Overview

- 8.5.2 Entry

- 8.5.3 Applicants

- 8.5.4 Parcels

- 8.5.5 Permits

- 8.5.6 Permit Database management

- 8.5.7 Notes for Permit Database

- 8.6 Census Tools

-

8.7 Revenue Tools

- 8.7.1 Overview

- 8.7.2 Entry of revenue data

- 8.7.3 Retrieval of revenue data

- 8.7.4 Revenue maps

- 8.7.5 Other revenue tools

- 8.8 Reports Tools

- 8.9 Settings

-

9. Databases

- 9.1 Permit Database

-

9.2 Plans

- 9.2.1 Accra

- 9.2.2 Kasoa

- 9.2.3 Dodowa

- 9.2.4 Sekondi-Takoradi

-

9.3 Census Database

-

9.4 Revenue Database

-

9.5 Report Database

-

9.6 Project Database

- 9.7 Address Database

-

Annexes 1-10

- A1. LUPMIS setup

- A2. Background to cartography/raster images

- A3. Glossary, index

- A4. Troubleshooting

- A5. Styles

- A6. Classification for landuse mapping/planning

- A7. GIS utilities

- A8. Map projection parameters

- A9. Regions / Districts

- A10. Standards

-

Annexes 11-20

- A11. LUPMIS distribution

- A12. Garmin GPS

- A13. Training

- A14. ArcView

- A15. Population statistics

- A16. Entry and display of survey data

- A17. External exercises

- A18. Programming

- A19. Paper sizes

- A20. Various IT advices

- A21. Contact, references

8. LUPMIS Tools > 8.7 Revenue Tools > 8.7.2 Entry of revenue data

8.7.2.9 Manual Entry and Import of Arrears

Level of expertise required for this Chapter: Intermediate; specifically for LUPMIS @ TCPD

If arrears are considered in the debts calculation, they have to be entered in LUPMIS either through a manual entry or through import from a file with the arrears.

A) Manual entry

For a very few arrears to be entered you can choose the manual entry. Enter the UPN or SubUPN of the property (or business) to define a new 'payment', eventhough it is a debt (a kind of a negative payment).

Revenue Tools > Entry > Payment: Property (or Business) > Enter UPN > Continue

> Enter only the amount of arrears in GHc (of the previous year, of course). Don't enter any other figures or values in this screen, and Save Payment.

- - - - -

B) Import of arrears from a CSV file (from Excel)

You have to prepare an Excel file with following columns:

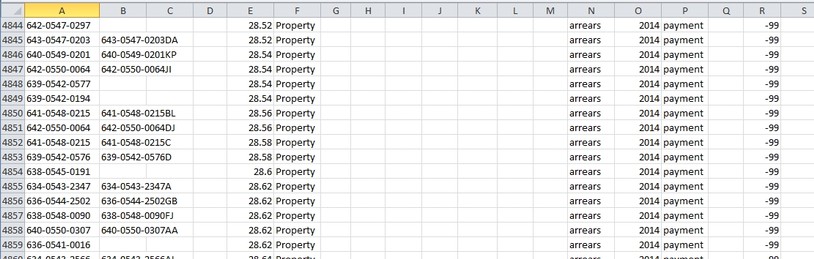

- UPN (and SubUPN, if applicable) (in column A [and B])- Amount of arrears (in GHc) (in column E for payment)- Word 'Property' or 'Business' (in column F)- Word 'Arrears' (in column G)- Year from when arrears is dating back (e.g. for the assessment in 2015, enter arrears year 2014) (in column O)- Word 'Payment' in a control column at the right side (in column P)- Control number -99 in the the very last column (column; R)

This will set the arrears as debit for the date of December 31.

It has to be saved as a CSV file with '_field_data' in its file name.

This special import can be called by ticking the box at the selection screen.